UPDATED Feb. 13, 2023: The Carlyle Group in 2022 was the most active buyer of commercial real estate in New York City by the number of deals, and the 10th in dollar volume, according to a PincusCo ranking. Carlyle Group closed 91 deals with a total of $512 million.

The top signatories for the Carlyle Group in New York include Jason Hart, a managing director based in New York, and Carter Martin, an associate with the law firm Allegretti & Associates.

The company, based in Washington, D.C., owns at least 173 commercial properties in New York City with 2,065,691 square feet, 1,907 residential units and a city-determined market value of $508 million. (Market value is typically about 50% of actual value.) The portfolio has $1 billion in debt, with top three lenders as Invesco Real Estate, Invesco, and Santander Bank respectively. Within the portfolio, the bulk, or 62 percent of the 2,065,691 square feet of built space are elevator properties, with walkup properties next occupying 15 percent of the space. The bulk, or 44 percent of the built space, is in Brooklyn, with Queens next at 33 percent of the space.

The map below illustrates the 91 properties in all asset classes that Carlyle Group purchased in 2022 for a total of $512 million, with properties acquired for $2 million to $5 million in blue, from $5 million to $10 million in fuchsia and $10 million and up in red.

2022 acquisitions of small rentals

2022 buying patterns of all asset classes

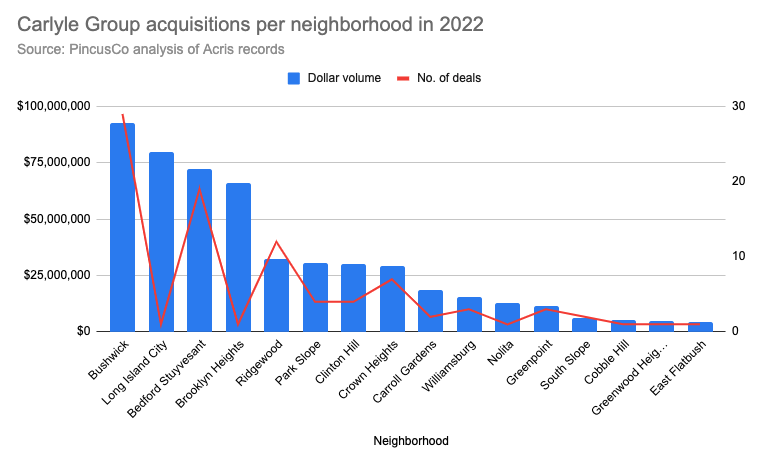

Last year, Carlyle Group’s purchases of all asset classes were concentrated in Brooklyn, in a handful of neighborhoods, reflecting the large number of small rental buildings discussed above.

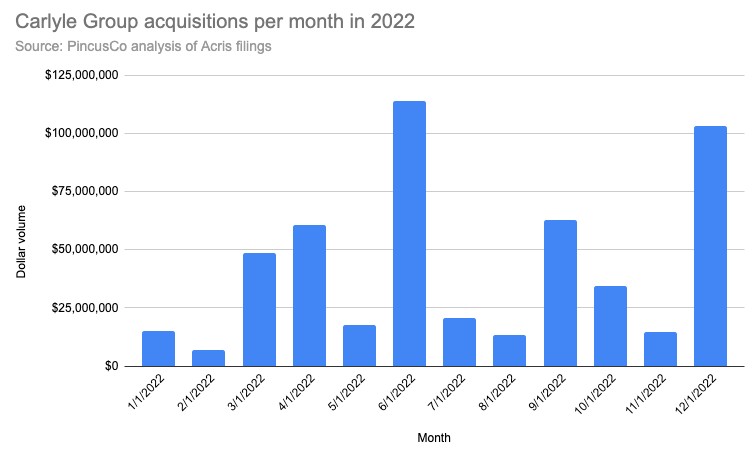

In terms of investment timing, the firm tended to close in the third month of a quarter, with June and December being the most active, followed by September.